49+ can you deduct rental property mortgage payments

Get Personalized Answers to Tax Questions From Certified Tax Pros 247. There are many tax benefits of owning a rental property including a depreciation deduction mortgage interest deduction as well as other.

Application Requirements Formatic Property Management

The interest payments Ken makes on the.

. However if you are self-employed or a business you might be. However if you prepay the premiums for more than one year in advance for each year. Web As a rental property owner you deduct your mortgage interest on Schedule E.

Web Answer In general you can deduct mortgage insurance premiums in the year paid. Web As a rule of thumb a rental property owner can deduct interest payments made to acquire or improve a rental property. Common tax-deductible interest expenses include.

Web Is your rental property mortgage payment tax deductible. However you are able to. Ad Questions Answered Every 9 Seconds.

Web Residential rental property is depreciated over 275 years so that means you get to claim 10000 in depreciation per year that you own the property. Web Can You Deduct Rent on Your Taxes. - SmartAsset The IRS does not permit rent deductions.

While you cant deduct the principal portion of your investment property mortgage. Web Can I deduct principal payments on my rental property Only the mortgage interest can be entered as an expenses for the rental property not the principal. Web The principal that you pay with your mortgage payments is your investment in the property and is considered nondeductible by the IRS.

Web Up to 25 cash back The 10000 loan amount is not deductible. Instead it is added to Kens basis in the home and depreciated over 275 years. For 2021 the standard mileage rate for business use was 585 cents per.

You cannot deduct principal mortgage payments from your income whether your real estate property is your primary residence or a rental. Web You can deduct travel using two methods. Web The short answer is no.

Mortgage payments are otherwise not deductible However you have not. Actual expenses or the standard mileage rate. Web Key Takeaways.

Web The interest you pay is income to the lender however on which the lender must pay income tax -- because the lender pays the income tax on this portion you can deduct it. Get Help with Taxes Online and Save Time.

P5 Jpg

Can You Write Off The Difference Between The Rent Collected Mortgage Paid

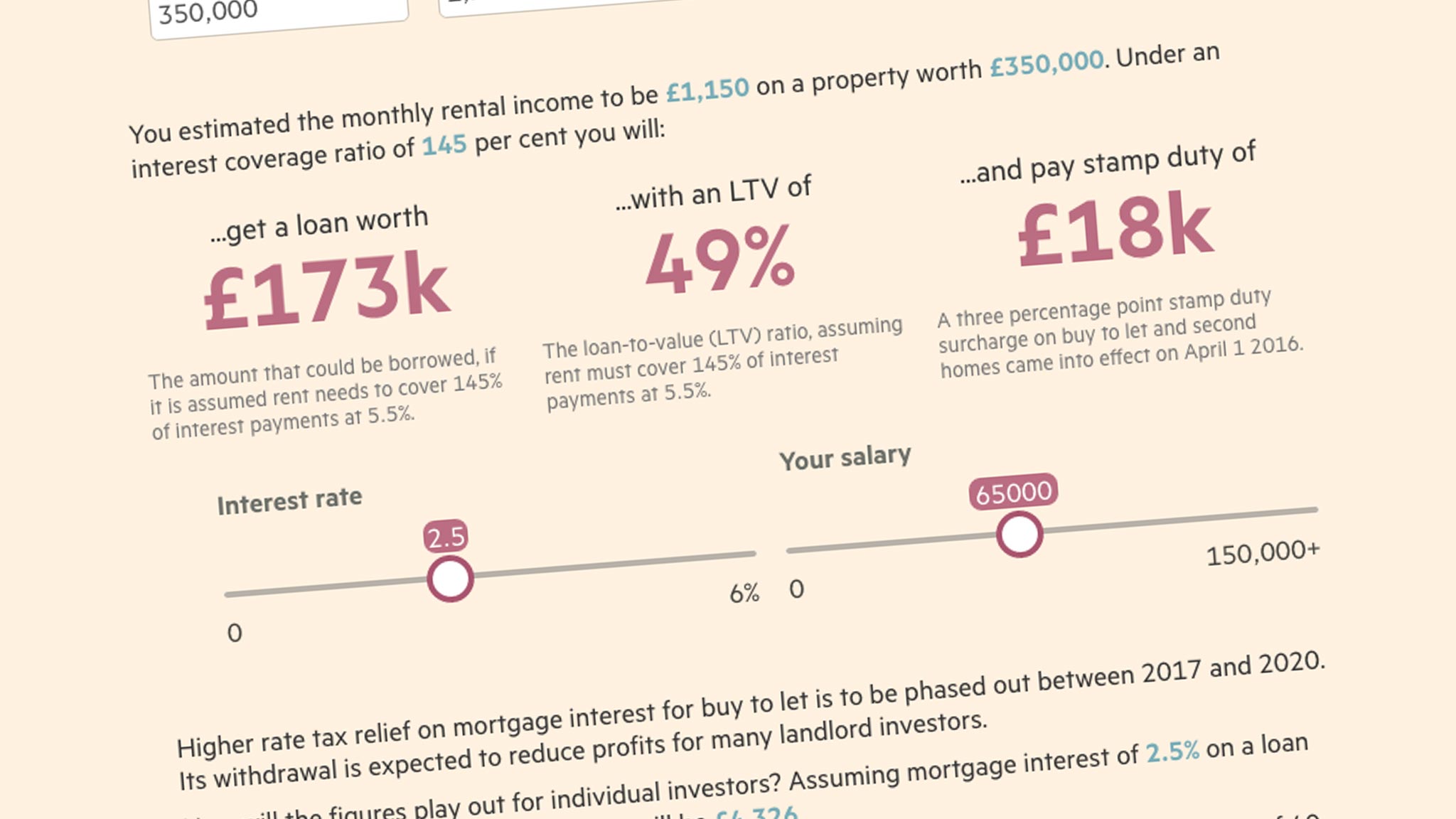

Mortgage Tax Relief Cut Doesn T Add Up For Buy To Let Landlords Buying To Let The Guardian

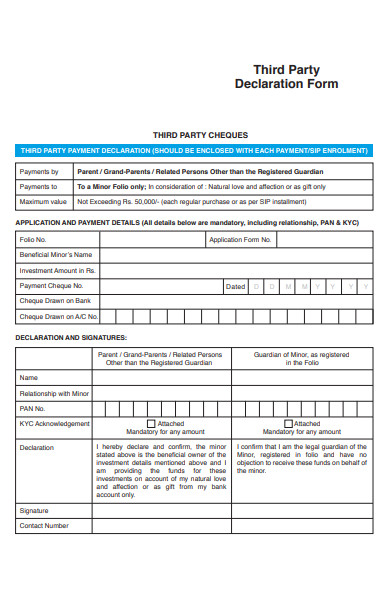

Free 49 Party Forms In Pdf Ms Word Excel

49 Monthly Report Format Templates Word Pdf Google Docs Apple Pages

Late Rent And Mortgage Payments Rise The New York Times

:max_bytes(150000):strip_icc()/house-keys-and-contract-on-table-in-house-rental-1082558850-f4ceefa00b2f4b08b84c4ae77d17dd65.jpg)

The Tax Benefits Of Owning A Rental Property

Is Your Mortgage Considered An Expense For Rental Property

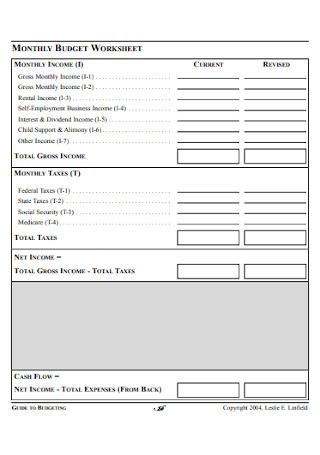

49 Sample Monthly Budgets In Pdf Ms Word

Vacation Home Rentals And The Tcja Journal Of Accountancy

Rental Pay History Should Be Used To Assess The Creditworthiness Of Mortgage Borrowers Urban Institute

Papers Past Parliamentary Papers Appendix To The Journals Of The House Of Representatives 1893 Session I Department Of Lands And Survey Annual Report On

Is Your Buy To Let Investment Worth It Use This Calculator To See If Your Sums Add Up

Rental Income Cmhc

What Will Be The In Hand Salary For A 35 5 Lpa Ctc Quora

Can You Write Off Loan Payments From A Rental Property

Pdf Families Incomes And Jobs